Francis I. duPont & Co. Genealogy: Part VII

Hirsch & Co., Continued

Hirsch, Lilienthal & Co. (founded 1911, New York)

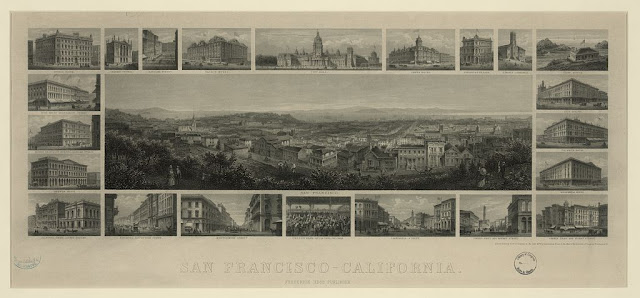

In 1911, Charles S. Hirsch joined forces with Joseph Leo Lilienthal (1880-1936) to create the firm of Hirsch, Lilienthal & Co. A graduate of Harvard (1902), Lilienthal was the son of Philip Nettre Lilienthal (1849-1908), a San Francisco banker. Born in New York and raised in Cincinnati, Philip was the son of Max Lilienthal, a respected Jewish rabbi and Bavarian immigrant. At the age of 18, Philip joined the firm of J.W. Seligman & Co. In 1869, the Seligmans sent him west to head up a San Francisco branch. In 1873, he set out on his own and founded the Anglo-Californian Bank. He married Isabella "Bella" Seligman (1859/1860-1906), the daughter of Joseph W. Seligman, who was the founder of the House of Seligman, in 1879. Born in 1880, Joseph Leo Lilienthal was Bella and Philip's oldest son. Before he joined in partnership with Charles Hirsch, Joseph worked at Goldsmith & Co. and had purchased a seat on the New York Stock Exchange in 1906.

After Lilienthal died in 1936 and Charles S. Hirsch died in 1938, Hirsch's oldest son, Howard Carlyle Hirsch (1896-1980), became the head of the firm. The firm was renamed Hirsch & Co. in 1944. In 1949, it had offices in New York, Chicago, Baltimore, Washington, Gastonia (North Carolina), London and a representative in Memphis and in Geneva, Switzerland. By mid-century, Hirsch & Co. was recognized as "a long-established and highly respected brokerage firm with an especially strong reputation in Europe."

Hirsch & Co. (founded 1944, New York)

In the late 1960s, Hirsch & Co. entered a critical time in its history. The volume of trade in the securities market increased dramatically. According to Irving Kaufman, "The paperwork simply overwhelmed the processing capacity of the industry carried on in the 'back offices,' and as the market fell in 1969, many firms found themselves in serious difficulty." That year, Hirsch & Co. posted a loss for the first time, and it was a considerably large loss of $2.8 million. The partners realized that "the Hirsch firm was not viable: the heavy trading volumes of the 'new' market required sophisticated data processing techniques that were beyond the means of the medium-sized brokerage." As several partners started to withdraw their capital, the firm's difficulties were further exacerbated. The series of events led the remaining partners to consider merging with another firm. In March 1970, Howard C. Hirsch and other partners started negotiations with the firm of Francis I. du Pont & Co. (founded 1931, New York). Howard C. Hirsch became a limited partner in the new firm and effectively retired from business. Though his family's name was not included in the newly merged firm, Hirsch stated, "Capital analysis has indicated to us that in today's securities markets there are distinct economic advantages in being able to do business as a large well-structured firm with extensive investment services and efficient market coverage." The new firm was called F.I. duPont, Glore Forgan & Co.

Comments

Post a Comment